Connect your money with your purpose. Steward wealth across generations.

BUILT FOR ENTREPRENEURS

Business owners, leaders, and executives entrust us to help them design and “live out” their legacies in a way that allows their family to thrive.

Increasing wealth brings increasing complexities, opportunities, and responsibilities to fuel the next generation toward greater purpose and impact.

Your personal balance sheet is its own business to operate.

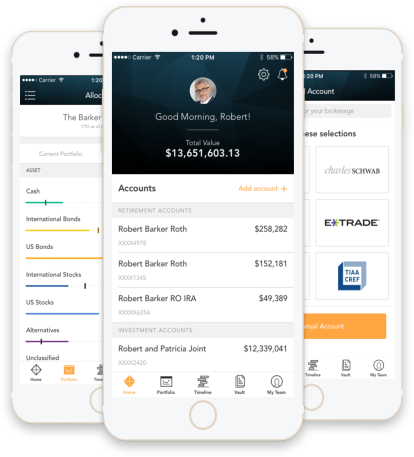

We help you simplify your complete financial picture, mitigate risks, and leverage opportunities to maximize the purpose you have for your wealth.

EXPLORE:

As an entrepreneur, your job is to stay focused on building your business.

You maintain a busy schedule, so managing your personal balance sheet often gets neglected. As a result, you recognize the need for a team of trusted advisors to keep you organized, provide a purposeful plan, and help you execute your priorities.

SOLUTIONS:

FINANCIAL STRATEGY

FAMILY ALIGNMENT

INVESTMENT MANAGEMENT

LEGACY BUILDING

WE PARTNER WITH YOU THROUGH EACH PHASE OF LIFE:

Do you have confidence that your portfolio aligns with your goals and risk tolerance?

Are you moving up the corporate ladder and need help organizing and managing an increasingly complex financial life?

Has your portfolio outgrown your current advisor, or your desire to manage it on your own?

Are you prepared for an exit, transition, or significant liquidity event?

We are built for entrepreneurs and builders like you.

We understand your challenges and deliver clarity and confidence to help you steward your wealth across generations.

EXPERIENCE CLARITY

We cut through the noise to keep you on track with your goals.

CONFIDENCE FOR THE FUTURE

We custom-build a financial strategy for your family's balance sheet.

GUIDANCE YOU TRUST

As fiduciaries, we serve your family with complete representation.

Get content designed to help you thrive financially.

SIGN UP FOR OUR NEWSLETTER

© 2024 ARKOS GLOBAL ADVISORS | DISCLOSURES

WATCH VIDEO

WATCH VIDEO